Pvm Accounting Fundamentals Explained

The smart Trick of Pvm Accounting That Nobody is Discussing

Table of ContentsThe Facts About Pvm Accounting Revealed7 Easy Facts About Pvm Accounting DescribedThe smart Trick of Pvm Accounting That Nobody is DiscussingThe 45-Second Trick For Pvm AccountingAn Unbiased View of Pvm AccountingTop Guidelines Of Pvm Accounting

Supervise and take care of the development and authorization of all project-related invoicings to customers to cultivate good communication and stay clear of problems. construction taxes. Ensure that proper records and documents are submitted to and are updated with the internal revenue service. Ensure that the audit process conforms with the regulation. Apply required building and construction bookkeeping criteria and treatments to the recording and reporting of building activity.Connect with numerous financing firms (i.e. Title Firm, Escrow Firm) regarding the pay application procedure and requirements needed for settlement. Aid with implementing and maintaining internal financial controls and procedures.

The above statements are intended to describe the basic nature and degree of work being carried out by people appointed to this category. They are not to be understood as an extensive listing of duties, obligations, and skills called for. Personnel might be called for to do tasks outside of their normal responsibilities once in a while, as needed.

Everything about Pvm Accounting

You will help sustain the Accel team to ensure shipment of successful on time, on spending plan, jobs. Accel is looking for a Building Accounting professional for the Chicago Office. The Building Accountant does a variety of bookkeeping, insurance coverage conformity, and project administration. Functions both independently and within certain divisions to maintain monetary records and make certain that all records are maintained current.

Principal obligations consist of, but are not limited to, dealing with all accounting functions of the business in a prompt and exact manner and supplying records and timetables to the company's CPA Firm in the prep work of all economic declarations. Ensures that all bookkeeping procedures and functions are handled properly. Liable for all monetary documents, pay-roll, financial and day-to-day procedure of the accountancy feature.

Functions with Job Managers to prepare and upload all regular monthly invoices. Generates month-to-month Task Cost to Date records and working with PMs to fix up with Project Supervisors' budget plans for each project.

The Buzz on Pvm Accounting

Efficiency in Sage 300 Construction and Genuine Estate (formerly Sage Timberline Workplace) and Procore building monitoring software a plus. https://j182rvzpbx6.typeform.com/to/qpx4zyP8. Have to likewise excel in other computer software program systems for the preparation of records, spread sheets and other accountancy evaluation that might be required by administration. Clean-up bookkeeping. Need to possess strong business abilities and ability to prioritize

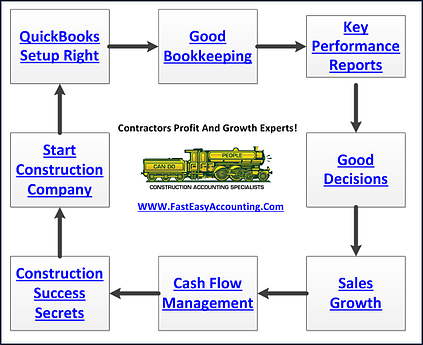

They are the monetary custodians that ensure that building tasks remain on spending plan, comply with tax obligation laws, and maintain financial openness. Construction accountants are not simply number crunchers; they are strategic partners in the building procedure. Their main duty is to manage the financial aspects of building jobs, making certain that sources are designated successfully and economic risks are minimized.

Pvm Accounting - The Facts

They function very closely with task supervisors to produce and keep an eye on budget plans, track expenses, and forecast economic demands. By preserving a tight grasp on job funds, accountants help protect against overspending and economic obstacles. Budgeting is a keystone of effective building and construction jobs, and construction accounting professionals contribute hereof. They create thorough budget plans that encompass all project expenses, from materials and labor to permits and insurance.

Construction accountants are skilled in these laws and ensure that the project conforms with all tax obligation needs. To excel in the role of a building accounting professional, people require a solid educational structure in audit and money.

In addition, certifications such as Certified Public Accountant (CPA) or Licensed Building Sector Financial Specialist (CCIFP) are very pertained to in the sector. Functioning as an accountant in the building and construction sector features an unique collection of obstacles. Building and construction tasks often involve tight target dates, transforming laws, and unanticipated expenditures. Accounting professionals have to adjust promptly to these obstacles to maintain the job's financial wellness undamaged.

Some Known Facts About Pvm Accounting.

Professional certifications like CPA or CCIFP are additionally very advised to show knowledge my blog in building bookkeeping. Ans: Construction accounting professionals develop and keep an eye on budget plans, identifying cost-saving possibilities and making certain that the task remains within budget. They also track expenditures and forecast financial requirements to stop overspending. Ans: Yes, building accounting professionals handle tax conformity for building and construction jobs.

Introduction to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make difficult choices amongst many monetary alternatives, like bidding on one task over another, choosing financing for products or equipment, or setting a task's earnings margin. Building is a notoriously unpredictable industry with a high failure rate, sluggish time to settlement, and inconsistent cash money circulation.

Production entails repeated processes with conveniently identifiable expenses. Production requires various procedures, materials, and devices with differing costs. Each task takes place in a new area with varying site problems and special challenges.

Pvm Accounting for Dummies

Durable relationships with vendors relieve arrangements and enhance performance. Inconsistent. Frequent use different specialty specialists and distributors affects performance and cash money circulation. No retainage. Settlement gets here in full or with regular payments for the full agreement quantity. Retainage. Some part of repayment may be kept till project completion even when the professional's work is finished.

Routine production and short-term agreements bring about convenient cash money flow cycles. Irregular. Retainage, slow-moving repayments, and high in advance expenses result in long, uneven cash money flow cycles - construction taxes. While conventional manufacturers have the advantage of controlled settings and maximized production procedures, building firms have to regularly adapt to every new task. Also rather repeatable projects call for modifications as a result of site problems and other factors.